Pick the Assessment Year and Also the format in which you Would like to View That the Form 26AS. View Tax Credit Traces. 26AS can also be viewed by logging in other taxguruin related sites which redirects Taxpayer to TRACES. An income taxpayer is no longer required to attach a photocopy of the TDS certificate along with Income Tax Return as long as he or she has Form 26AS. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Article explains the password combination for Opening ITR-VAcknowledgement Form 26AS Any IntimationOrder and TDS Provisional ReceiptAcknowledgement and for extracting TDS Justification Report Conso File TDS Certificates ZIP File and 26AS ZIP File. It is one of the most important documents taxpayers should verify before filing their ITR. Logon to e-Filing Portal wwwincometaxindiaefilinggovin. This information is specific to a Permanent Account Number PAN. Log in to income tax new website incometaxgovin.

Go to the e-file menu click on Income tax returns Select View Form 26AS. Ad Find How To Do My Income Tax. Form 26AS is consolidated from multiple sources like your salary pension interest income etc. Form 26AS contains the following information partwise. Income Tax Department facilitates a PAN holder to view its Tax Statement Form 26AS online. 26AS can also be viewed by logging in other taxguruin related sites which redirects Taxpayer to TRACES. Data updated till 21-Jul-2018 Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN GYCPS3989A Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19 Name of Assessee. Along With Date Of Birth In Lower CaseEXAMPLE. Form 26AS is an annual consolidated tax credit statement that taxpayers can access view or download from the income tax departments e-filing website. Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN AKNPS1129B Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19.

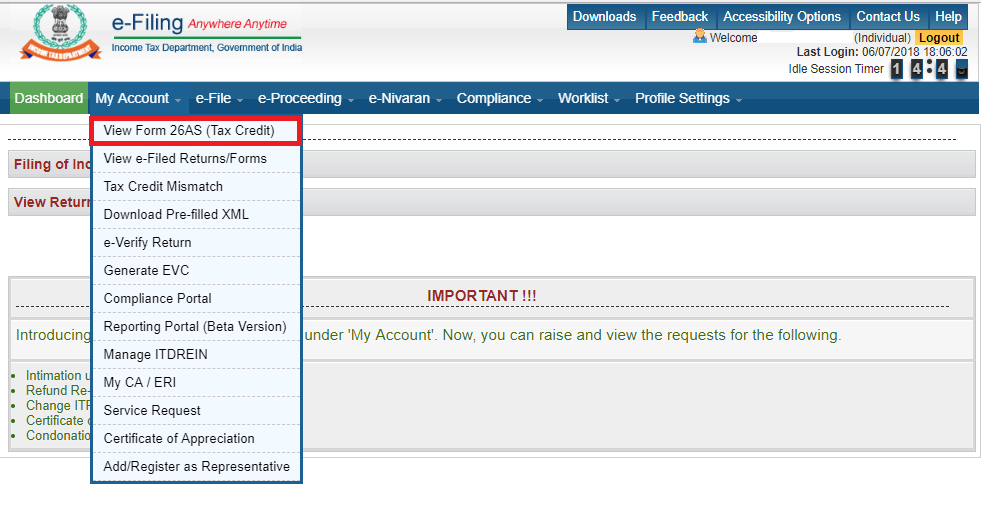

The form also shows details of salepurchase of immovable property mutual funds cash. Ad Find Free Tax Return. Along With Date Of Birth In Lower CaseEXAMPLE. Ad Find Free Tax Return. The Income Tax Department will allow a taxpayer to claim the credit of taxes as reflected in his or her Form 26AS if no other payments are due from him or her as income tax or interest thereon. Ad Find How To Do My Income Tax. Form 26AS is consolidated from multiple sources like your salary pension interest income etc. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. Click on Login on the top right of the home page. Go to the My Account menu click View Form 26AS Tax Credit link.

Form 26AS is consolidated from multiple sources like your salary pension interest income etc. 10 Important Income Tax Form under Income Tax Act 1961 One must know. Ad Find How To Do My Income Tax. For downloading Form 26AS a taxpayer needs to follow the following steps. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Article explains the password combination for Opening ITR-VAcknowledgement Form 26AS Any IntimationOrder and TDS Provisional ReceiptAcknowledgement and for extracting TDS Justification Report Conso File TDS Certificates ZIP File and 26AS ZIP File. Form 26AS contains the following information partwise. Data updated till 21-Jul-2018 Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN GYCPS3989A Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19 Name of Assessee. 26AS is available for download in two formats. The Income Tax Department will allow a taxpayer to claim the credit of taxes as reflected in his or her Form 26AS if no other payments are due from him or her as income tax or interest thereon.

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. Log in to income tax new website incometaxgovin. 26AS is available for download in two formats. It is one of the most important documents taxpayers should verify before filing their ITR. Go to the e-file menu click on Income tax returns Select View Form 26AS. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. 10 Important Income Tax Form under Income Tax Act 1961 One must know. Ad Find How To Do My Income Tax. The form also shows details of salepurchase of immovable property mutual funds cash. Pick the Assessment Year and Also the format in which you Would like to View That the Form 26AS.