Equity is the owners claim against the assets or the owners interest in the entity. Assets Liabilities Equity. On the balance sheet spotting creative accounting practices can be broken down into three categories for analysis. 200000 100000 100000. Assets Liabilities Equity And turn it into the following. Organizes assets and liabilities into important subgroups that provide more information. Closing the revenue accounts transferring the credit balances in the revenue accounts to a clearing account called Income Summary. All temporary accounts are closed but not the permanent accounts. Which of the following are classified as current assets. Examples include revenue and expense items.

Assets liabilities and stockholders equity accounts are real accounts and do not get closed at the end of the period. Income statement accounts are temporary accounts that are closed at the end of the period. Reduction of federal income tax liability. 200000 100000 100000. If equity is negative then you have some problems. Assets liabilities and equity accounts are not closed. Only revenue expense and dividend accounts are closednot asset liability Common Stock or Retained Earnings accounts. Revenues expenses and withdrawals accounts which are closed at the end of each accounting period are. The assets are 25 the liabilities equity 25 15 10. These accounts are called.

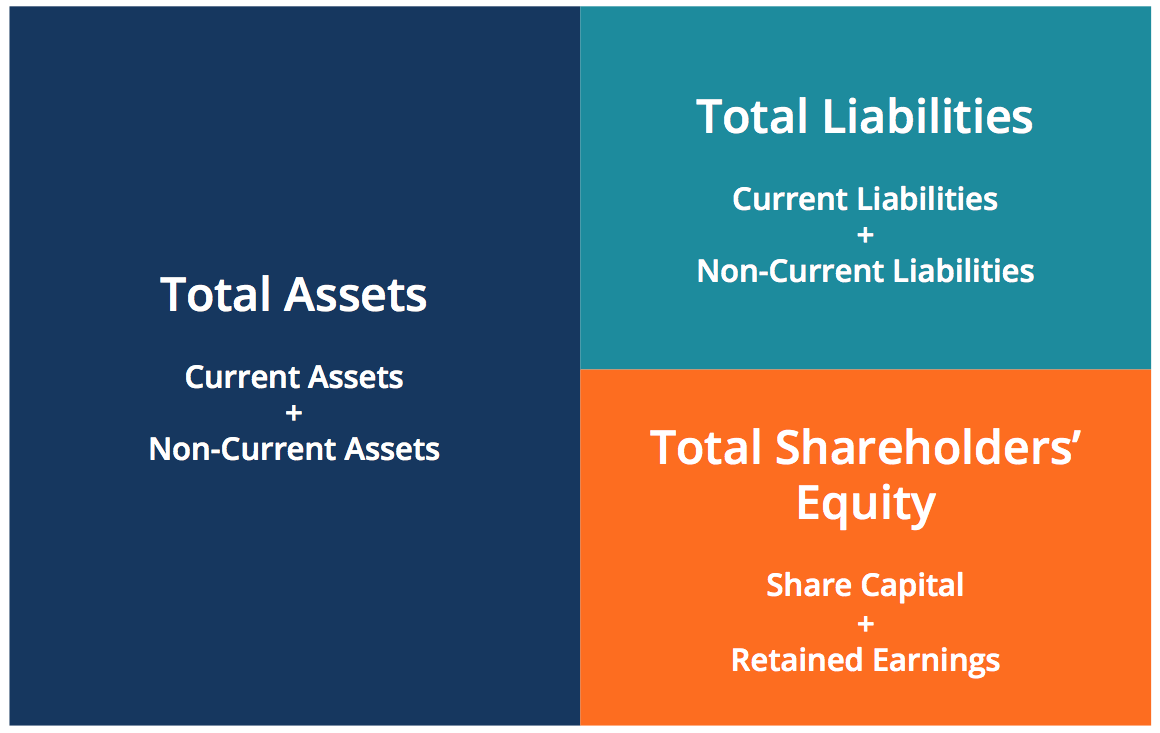

First of all you make sure all of your balance sheet accounts are in balance. These accounts are called. All temporary accounts are closed but not the permanent accounts. On the balance sheet spotting creative accounting practices can be broken down into three categories for analysis. These sections look at each part of the equation. Assets liabilities and equity accounts are not closed. Overstating assets andor. Question 9 1 1 pts Select the purpose of capitalizing certain costs of doing business when they are incurred and then over subsequent accounting cycles depreciated or amortized. The accounting equation is. Assets Liabilities Equity And turn it into the following.

Organizes assets and liabilities into important subgroups that provide more information. These accounts are called. The accounting equation is. Use the accounting equation to balance out your needs. These accounts are called. Real accounts remain open as long as the asset liability or equity items recorded in the accounts continue in existence. Income statement accounts are temporary accounts that are closed at the end of the period. Transcribed Image Textfrom this Question. Which of the following are classified as current assets. Question 9 1 1 pts Select the purpose of capitalizing certain costs of doing business when they are incurred and then over subsequent accounting cycles depreciated or amortized.

Real accounts remain open as long as the asset liability or equity items recorded in the accounts continue in existence. Lets take the equation we used above to calculate a companys equity. Equity - Doesnt Close Corporation This represents equity that is carried forward from year to year like common stock. Assets liabilities and equity accounts are not closed. Income statement accounts are temporary accounts that are closed at the end of the period. Then your accounting equation is. Closing the revenue accounts transferring the credit balances in the revenue accounts to a clearing account called Income Summary. Only revenue expense and dividend accounts are closednot asset liability Common Stock or Retained Earnings accounts. Assets Liabilities Equity And turn it into the following. Examples include revenue and expense items.