According to these financial ratios Walmart Incs valuation is way above the market valuation of its sector. 21 rows PE Ratio. Quote Stock Analysis News Price vs Fair Value Trailing Returns Financials. Adjusted net profit margin. The ratio compares the share price to earnings per share EPS. A low PCF ratio tends to show depending on the industry that a firm is generating ample cash flows to sustain its business and that the stock price has not yet accurately reflected the excess cash. The company under review is Wal-Mart. The average P E ratio varies by industry but overall it is around 15. However in the last two years the organization would take steps to reduce the long-term debt ratio ending 2021 at 163. The lower the better.

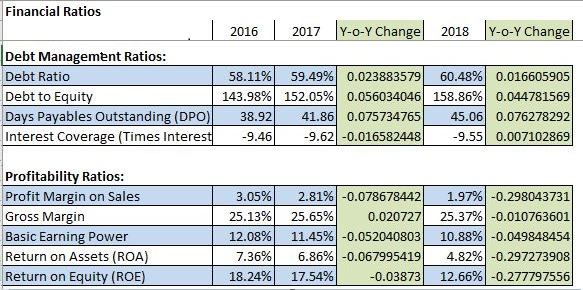

Total Debt to Enterprise Value 014. Adjusted net profit margin. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Walmart Incs latest financial reports. The ratio compares the share price to earnings per share EPS. Walmarts debt ratio for 2017 was 211. The EVEBITDA NTM ratio of Walmart Inc. By comparing it to similar entities like industry or sector on the basis of several relative ratios that compare its stock price to relevant variables that affect the stocks value such as earnings book value and sales. The higher the better. This paper will review some of the financial ratios that will help analyze how Wal-Mart is doing financially. In the next two years the organizations debt ratio would slightly increase to 228.

This paper will review some of the financial ratios that will help analyze how Wal-Mart is doing financially. The financial condition of Walmart Inc. Walmart Incs adjusted financial leverage ratio increased from 2019 to 2020 but then decreased significantly from 2020 to 2021. The EVEBITDA NTM ratio of Walmart Inc. Quote Stock Analysis News Price vs Fair Value Trailing Returns Financials. It is based on these factors. Walmarts interest coverage ratio was 107 for the fiscal third quarter of 2020. Current and historical current ratio for Walmart WMT from 2006 to 2021. The ratio compares the share price to earnings per share EPS. As of Q2 2020 Walmarts P E ratio is approximately 2388 which means WMT shares are trading on the market at around 24 times.

Total Debt to EBITDA 128. However in the last two years the organization would take steps to reduce the long-term debt ratio ending 2021 at 163. The financial condition of Walmart Inc. In 2021 is about the same as the financial condition typical of the companies engaged in the activity Variety Stores The average ratios for this industry are slightly better than the averages for all industries. It is based on these factors. The higher the better. Common Stock Valuation Ratios Relative valuation technique determine the value of Walmart Inc. A low PCF ratio tends to show depending on the industry that a firm is generating ample cash flows to sustain its business and that the stock price has not yet accurately reflected the excess cash. Rating as of Jul 12 2021. Total Debt to Enterprise Value 014.

1 Walmarts interest coverage ratio started falling drastically in 2017 before bottoming in in late 2018 and has. Walmarts debt ratio for 2017 was 211. The average P E ratio varies by industry but overall it is around 15. The EVEBITDA NTM ratio of Walmart Inc. Walmarts Debt Ratio. Is significantly higher than the average of its sector Broadline Retailers. 21 rows PE Ratio. However in the last two years the organization would take steps to reduce the long-term debt ratio ending 2021 at 163. According to these financial ratios Walmart Incs valuation is way above the market valuation of its sector. In 2021 is about the same as the financial condition typical of the companies engaged in the activity Variety Stores The average ratios for this industry are slightly better than the averages for all industries.