Trial balance helps a professional accountant to balance or check both debit and credit items of income expenses assets and liabilities are correctly recorded or posted. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. The zero items are not usually included. A trial balance shows a summary of how much Cash Accounts Receivable Supplies and all other accounts the company has after the posting process. The account names are listed as arranged in the ledger and the balances are placed either on the debit or credit column. A trial balance consists of the following information. Trial Balance Definition A trial balance often gets confused with a balance sheet or an income statement. Ledger balances are segregated into debit balances and credit balances. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. The total dollar amount of the debits and credits in each accounting entry are supposed to match.

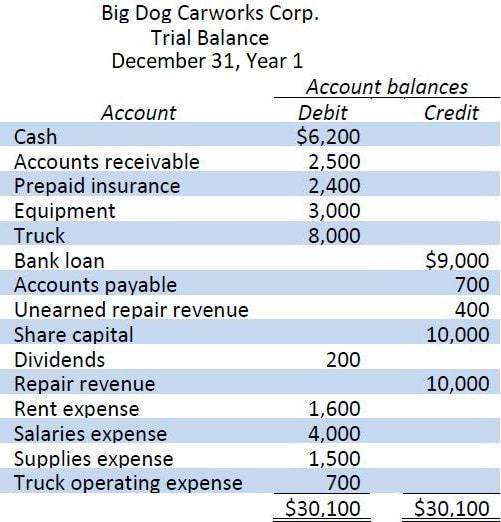

Normally the entity records its daily business transactions in general ledgers. From a practical perspective accounting. Ledger balances are segregated into debit balances and credit balances. One column is headed Debit and the other column is headed Credit. Trial balance helps a professional accountant to balance or check both debit and credit items of income expenses assets and liabilities are correctly recorded or posted. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading Debit balances and the credit balance amounts are listed in another column with the heading Credit balances. A trial balance is a report that lists the balance of the accounts in a businesss general ledger. To illustrate heres a trial balance example. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. The report is primarily used to ensure that the total of all debits equals the total of all credits which means that there are no unbalanced journal entries in the accounting system that would make it impossible to generate accurate financial statements.

A trial balance is a report that lists the balance of the accounts in a businesss general ledger. The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. To lag or linger. From a practical perspective accounting. A trial balance consists of the following information. The report is primarily used to ensure that the total of all debits equals the total of all credits which means that there are no unbalanced journal entries in the accounting system that would make it impossible to generate accurate financial statements. Ledger balances are segregated into debit balances and credit balances. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading Debit balances and the credit balance amounts are listed in another column with the heading Credit balances. The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits.

A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. The zero items are not usually included. The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits. After posting all financial transactions to the accounting journals and summarizing them in the general ledger a trial balance is prepared to verify that the debits equal the credits on the chart of accountsThe trial balance is the next step in the accounting cycleIt is the first step in the end of the accounting period process. The accounts reflected on a trial balance are related to all major accounting. Its an internal document that helps accountants ensure that the books are balanced. A trial balance lists the ending balance in each general ledger account. A trial balance sometimes abbreviated to TB is a list of all the account balances in the accounting records on a particular date. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries.

One column is headed Debit and the other column is headed Credit. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. Trial Balance Definition A trial balance often gets confused with a balance sheet or an income statement. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance. For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. The act of testing somethingTrying something to find out about it. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. The total dollar amount of the debits and credits in each accounting entry are supposed to match. A trial balance shows a summary of how much Cash Accounts Receivable Supplies and all other accounts the company has after the posting process.