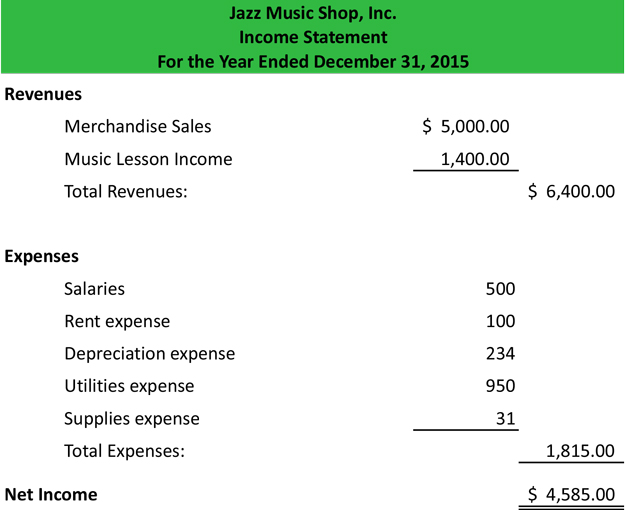

An income statement is one of the three along with balance sheet and statement of cash flows major financial statements that reports a companys financial performance over a specific accounting. Income statement definition an accounting of income and expenses that indicates a firms net profit or loss over a certain period of time usually one year. The purpose of the income statement is to show the reader how much profit or loss an organization generated during a reporting period. Allows shareholdersowners to see how the business has performed and whether it has made an. It shows the profit or loss made by the business which is the difference between the firms total income and its total costs. It shows your revenue minus your expenses and losses. It also shows whether a company is making profit or loss for a given period. Non-operating revenues and gains. The purpose of the income statement is to provide the financial earnings performance of the entity over a specific period of time. The income statement also called a profit and loss statement is a report made by company management that shows the revenue expenses and net income or loss for a period.

The income statement is a historical record of the trading of a business over a specific period normally one year. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. Income statement accounts are used to sort and store transactions involving. The income statement also called a profit and loss statement is a report made by company management that shows the revenue expenses and net income or loss for a period. A classified income statement is a financial report showing revenues expenses and profits for which there are subtotals of the various revenue and expense classifications. It shows the profit or loss made by the business which is the difference between the firms total income and its total costs. The format of the income statement components allows for dissecting the revenues expenses operating income and profits of an entity. An income statement is one of the three along with balance sheet and statement of cash flows major financial statements that reports a companys financial performance over a specific accounting. The purpose of the income statement is to provide the financial earnings performance of the entity over a specific period of time. Purpose of the Income Statement.

It shows your revenue minus your expenses and losses. The income statement serves several important purposes. The classified format is used for more complex income statements to make them easier for users to read. It is also referred to as a profit and loss statement or earnings statement. The income statement is one of the five financial statements that report and present an entitys financial transactions or performance including revenues expenses net profit or loss and other PL Items for a specific period of time. The format of the income statement components allows for dissecting the revenues expenses operating income and profits of an entity. Non-operating expenses and losses. The financial statement that represents the income and expenses of the company for a particular or given period is called an income statement. A classified income statement is a financial report showing revenues expenses and profits for which there are subtotals of the various revenue and expense classifications. It is one of the financial statements that show the.

Allows shareholdersowners to see how the business has performed and whether it has made an. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. It shows your revenue minus your expenses and losses. Income statement definition an accounting of income and expenses that indicates a firms net profit or loss over a certain period of time usually one year. Purpose of the Income Statement. This is also known as the statement of financial performance because it shows how the entity financially performed during the period that the. An income statement is a financial statement detailing a companys revenue expenses gains and losses for a specific period of time that is submitted to the Securities and Exchange Commission SEC. The income statement also called a profit and loss statement is a report made by company management that shows the revenue expenses and net income or loss for a period. The income statement is a historical record of the trading of a business over a specific period normally one year. The income statement is also referred to as the profit and loss statement PL statement of income and the statement of operations.

The purpose of the income statement is to show the reader how much profit or loss an organization generated during a reporting period. It shows the profit or loss made by the business which is the difference between the firms total income and its total costs. Large companies may have thousands of income statement accounts in order to budget and report revenues and expenses by divisions product lines departments. The classified format is used for more complex income statements to make them easier for users to read. It shows your revenue minus your expenses and losses. This information is more valuable when income statements from several consecutive periods are grouped together so that trends in the different revenue and expense line items can be viewed. Income statement definition One of the main financial statements along with the balance sheet the statement of cash flows and the statement of stockholders equity. At the most basic level it shows profit and loss. The income statement is one of the five financial statements that report and present an entitys financial transactions or performance including revenues expenses net profit or loss and other PL Items for a specific period of time. Non-operating revenues and gains.