A contra account for revenues ie a revenue account that has a debit balance rather than the credit balance of a typical revenues account. It is a deduction from equity because it represents the amount paid by a corporation to buy back its stock. A contra revenue account allows a company to see the original amount sold and to also see the items that reduced the sales to the amount of net sales. Examples of expenses are office supplies utilities rent entertainment and travel. A contra revenue account carries a debit balance and reduces the total amount of a companys revenue. Contra revenue accounts include sales discounts sales returns and sales allowances which all by. Contra revenue is a deduction from the gross revenue reported by a business which results in net revenue. Again accumulated depreciation reduced fixed and capital asset balances. Sales Returns Contra Revenue Account. The sales returns contra sales account records the sales value of goods returned by a customer.

Sales returns contra revenue account. Sale Returns contra revenue accounts are useful in demonstrating the impact on net revenue of returns and refunds. To illustrate the contra revenue account Sales Returns and Allowances lets assume that Company K sells 100000 of. The contra revenue accounts list includes the following. A contra revenue account carries a debit balance and reduces the total amount of a companys revenue. Contra revenue is a deduction from the gross revenue reported by a business which results in net revenue. For instance a fixed asset such as machinery a company building office equipment vehicles or even office furniture would be highlighted in an accumulated depreciation account. It is the contra revenue account. This is another non-operating revenue because it is not a day-to-day activity and is not the main operation of your business. A contra revenue account allows a company to see the original amount sold and to also see the items that reduced the sales to the amount of net sales.

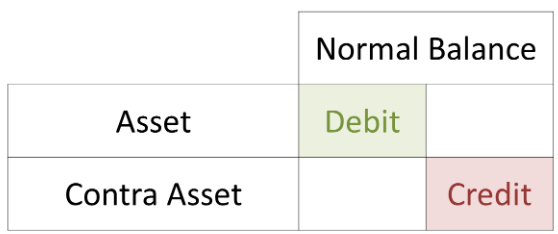

What is a contra-revenue account. Sales Returns and Allowances. Sales returns contra revenue account. Contra revenue transactions are recorded in one or more contra revenue accounts which usually have a debit balance as opposed to the credit balance in the typical revenue account. Two examples of contra revenue accounts are. Give two examples of contra-revenue accounts. There are three examples of contra revenue accounts. An accumulated depreciation account is a type of contra asset account that is used for recording the amount of depreciation a fixed asset evolves through. It is the contra revenue account. Contra revenues account definition.

Contra revenue accounts include sales discounts sales returns and sales allowances which all by. This is another non-operating revenue because it is not a day-to-day activity and is not the main operation of your business. Sales returns contra revenue account. Purchase returns allowances and discounts are all examples of contra expense accounts. What is a contra-revenue account. Contra revenue is a deduction from the gross revenue reported by a business which results in net revenue. An accumulated depreciation account is a type of contra asset account that is used for recording the amount of depreciation a fixed asset evolves through. The Contra Revenue Account Contra revenue is a deduction from gross revenue which results in net revenue. Sale Returns contra revenue accounts are useful in demonstrating the impact on net revenue of returns and refunds. Sales returns sales allowances and sale discounts.

Give two examples of contra-revenue accounts. There are three examples of contra revenue accounts. Contra revenues account definition. Sales Discounts Contra Revenue Account. Sales returns contra revenue account. Examples of Contra Revenue Accounts. Sales Returns and Allowances. The sales allowance shows the discounts given to customers when returning the product. The sales returns contra sales account records the sales value of goods returned by a customer. Within equity an example of a contra account is the treasury stock account.