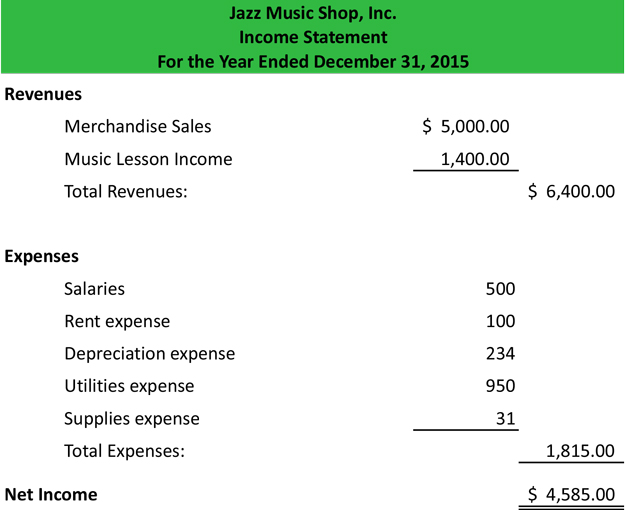

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. Revenues expenses and net income. The income statement shows investors and management if the firm made money during the period reported. Income statement accounts are also referred to as temporary accounts or nominal accounts because at the end of each accounting year their balances will be closed. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. The income statement would include following sections basically. This means that the balances in the income statement accounts will be combined and the net. An income statement under absorption costing includes which of the following. It shows your revenue minus your expenses and losses. This is the cumulative money generated within a specific period including both expected income and firms costs.

The income statement shows investors and management if the firm made money during the period reported. What is an income statement. The income statement comes in two forms multi-step and single-step. This is the cumulative money generated within a specific period including both expected income and firms costs. The operating section of an income statement includes revenue and expenses. A proper understanding of these financial statements helps investors to know the profitability and financial soundness of the company. The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. The income statement shows investors and management if the firm made money during the period reported. Income statement accounts are also referred to as temporary accounts or nominal accounts because at the end of each accounting year their balances will be closed. The income statement summarizes a companys revenues and expenses over a period either quarterly or annually.

The income statement shows investors and management if the firm made money during the period reported. The income statement comes in two forms multi-step and single-step. This means that the balances in the income statement accounts will be combined and the net. As part of the statement of stockholders equity 68. The operating section of an income statement includes revenue and expenses. Second income statement c. Combined statement of comprehensive income d. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities. The operating section of an income statement includes revenue and expenses. A statement of comprehensive income that includes revenue cost of sales selling expenses and financial expenses would have been prepared using the.

The income statement comes in two forms multi-step and single-step. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. Which disclosure method do most companies use to display the components of other comprehensive income. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. The income statement includes elements like revenue expenses gross profit and losses. An income statement under absorption costing includes which of the following. The income statement shows investors and management if the firm made money during the period reported. The income statement shows investors and management if the firm made money during the period reported. Income statements are used to report the operating costs and profits of a business while assisting team leaders with making important business decisions. Second income statement c.

The income statement shows investors and management if the firm made money during the period reported. The operating section of an income statement includes revenue and expenses. Second income statement c. The income statement is one of three statements. Income statements are used to report the operating costs and profits of a business while assisting team leaders with making important business decisions. The income statement summarizes the financial impact of operating activities undertaken by the company during the accounting period. An income statement is an important document for all businesses that sell goods or offer services. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. An income statement under absorption costing includes which of the following. Combined statement of comprehensive income d.